Future Technologies and Megatrends

Invest in megatrends through equity mutual funds

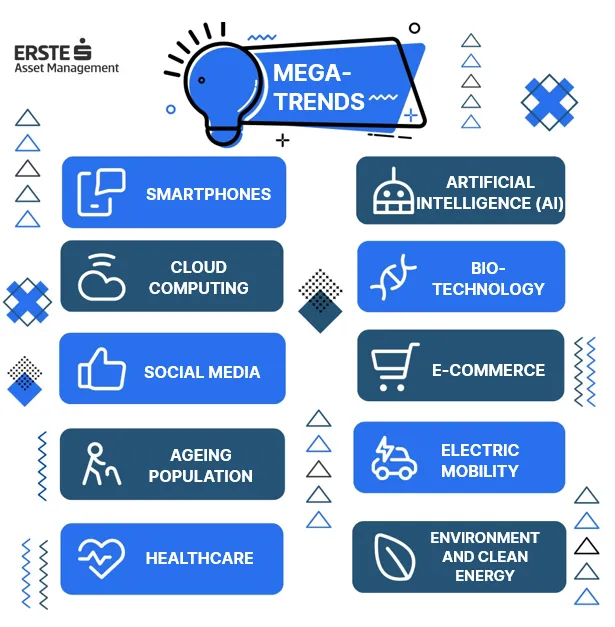

Megatrends will shape the world in the coming decades. We are at the beginning of far-reaching developments in human lifestyles, the use of new technologies (e.g. artificial intelligence), breakthroughs in healthcare or in the environment (e.g. clean energy). Megatrends generate growth and therefore opportunities for investors who invest in the most exciting companies. With the Fond maximalizovaných výnosov and the Fond budúcnosti, you can invest in companies that focus on these technologies and megatrends. Please note that investing in securities carries risks in addition to the opportunities described above.

Megatrends will shape the world in the coming decades. We are at the beginning of far-reaching developments in human lifestyles, the use of new technologies (e.g. artificial intelligence), breakthroughs in healthcare or in the environment (e.g. clean energy). Megatrends generate growth and therefore opportunities for investors who invest in the most exciting companies. With the Fond maximalizovaných výnosov and the Fond budúcnosti, you can invest in companies that focus on these technologies and megatrends. Please note that investing in securities carries risks in addition to the opportunities described above.

Will a watch save your life?

Read our blog to find out how companies are connecting technology and healthcare through wearables. You'll also find out, for example, how fast the sector is growing or who the biggest players are.

Invest regularly in innovation and megatrends

Invest regularly from as little as €20 per month in AI, cybersecurity, autonomous driving and other technologies through the Fond budúcnosti or the Fond maximalizovaných výnosov.

Technological megatrends

Fond budúcnosti and Fond maximalizovaných výnosov invest in future technologies, 21st century technology megatrends and pioneering companies, particularly in the technology sector. The world is becoming more technologically advanced and ongoing innovation is driving growth in this sector. Investments are being made in the following areas, among others:

Artificial intelligence

The new technology offers a wide range of potential uses. However, it is difficult to predict who will benefit from AI in the long term.

Cloud Computing

More and more applications are moving online. However, trends are also subject to fluctuations.

Cybersecurity

Companies will need to protect their infrastructure more effectively against growing threats.

Digital payments

Digital payment solutions are gaining importance in online retail. However, trends are also subject to fluctuations.

Social networks

Social networks are with us every day and offer new opportunities, for example in advertising. However, the use of individual social networks can change over time.

Robotics

The use of robots can provide a boost in manufacturing and services. However, it is not yet clear which companies will benefit most in the long term.

Investing in megatrends with the Fond budúcnosti

With the Fond budúcnosti, you can invest in a broad portfolio of companies. This includes, for example, traded companies in the semiconductor, artificial intelligence (AI), environment & clean energy or healthcare sectors. Notable stock positions in the fund include Nvidia, Novo Nordisk or TSMC, to name a few.

Please note that investing in equities involves risks as well as opportunities.

Do you want to know more about Fond budúcnosti?

Technological pioneers

The fund invests in high-quality, high-growth companies in the technology sector.

Diversification

Broadly diversified investments in a variety of companies, particularly in the technology sector.

Price fluctuations

The price of the fund may fluctuate significantly due to various influencing factors.

Investment in a broadly diversified Fond maximalizovaných výnosov

Fond maximalizovaných výnosov is focused on innovative companies with a competitive advantage and growth potential. In terms of the fund's sector allocation, the largest sector is information technology. However, stocks from more traditional sectors such as financials, consumer staples or industrials can also be found in the fund.

Please note that investing in securities involves risks as well as opportunities.

Do you want to know more about Fond maximalizovaných výnosov?

The Fund's core ideas

Opportunities for growth

The business model of the companies in the fund has the potential to achieve higher margins, higher market share or dramatic growth.

Competitiveness

Companies have a diversified source of income, a strong capital base and identifiable competitive advantages. They are able to penetrate new markets and adapt quickly to technological advances.

Innovation

Companies are focused on innovative industries. They bring new products and services in a rapidly changing market environment. They are well positioned to become leaders in key industries of the future.

Words from the portfolio manager of Fond maximalizovaných výnosov

Ján Beňák says about the selection of stock titles for the fund that it is not enough to follow the financial indicators, first it is necessary to have a good understanding of what the company does.

Fond maximalizovaných výnosov that you manage has an excellent long-term track record. What is your strategy?

"The fund's core ideas are growth, competitive advantage and innovation. Fond maximalizovaných výnosov does buy shares, but they only represent a share of ownership of a particular company with a particular business. We therefore try to select titles that have the prospect of growing in both earnings and revenue, have some advantage over their competitors and also innovate in order to gain or maintain market share."

More on future technologies and megatrends

DeepSeek: Sputnik moment for AI?

In response to DeepSeek's AI announcement, Nvidia wiped $589 billion off its market capitalization in one day. Find out exactly what Deepseek is and what changes could happen in the world of AI because of it in this blog post.

The space industry under Trump

Read a blog about the future of the space industry. More support for the sector is expected under the new US President Trump. In the blog you will find out how big the industry could be or which companies could be the leaders.

How are semiconductor chips made?

Read our blog about the semiconductor chip production chain, to find out how it works or what companies like Nvidia, AMD or TSMC do.

Will streaming platforms replace traditional TV?

Read our blog on the future of TV and streaming. For example, find out who the biggest players in streaming are or how streaming will affect sports coverage.

Artificial intelligence - tool or toy?

We're just at the beginning of the big hype around AI, and who is AI even good business for?

What impact can DeepSeek have on companies from the technology sector?

Deepseek has caused a big buzz in the AI world. In this blog, you can read about the implications this new AI model could have on specific companies such as Nvidia, Microsoft, Meta or Apple.

Invest online with George or arrange a meeting in branch

Online via George

Completely online without visiting a branch

Meeting in the branch

Make an appointment at your nearest branch

This is a marketing communication. Please refer to the fund's Statute, the fund's Sales Prospectus and to the Key Information Document before making any final investment decisions. They can be obtained in Slovak language at all sales points of the management company and at www.erste-am.sk.

The mutual funds are managed by Erste Asset Management GmbH, with registered office at Am Belvedere 1, 1100 Vienna, Austria, registered in the Commercial Register of the Commercial Court of Vienna under registration number 102018 b, which is doing business in the territory of the Slovak Republic through the organisational unit Erste Asset Management GmbH, pobočka Slovenská republika, with registered office at Tomášikova 48, 832 65 Bratislava, IČO: 51 410 818, registered in the Commercial Register of the Municipal Court of Bratislava III, Section: Po, Insert No.: 4550/B. Investing in mutual funds is also associated with risk. The value of the investment may also decrease and there is no guarantee of a return on the amount originally invested. Past returns on an investment in mutual funds are no guarantee of future returns.